wa car sales tax calculator

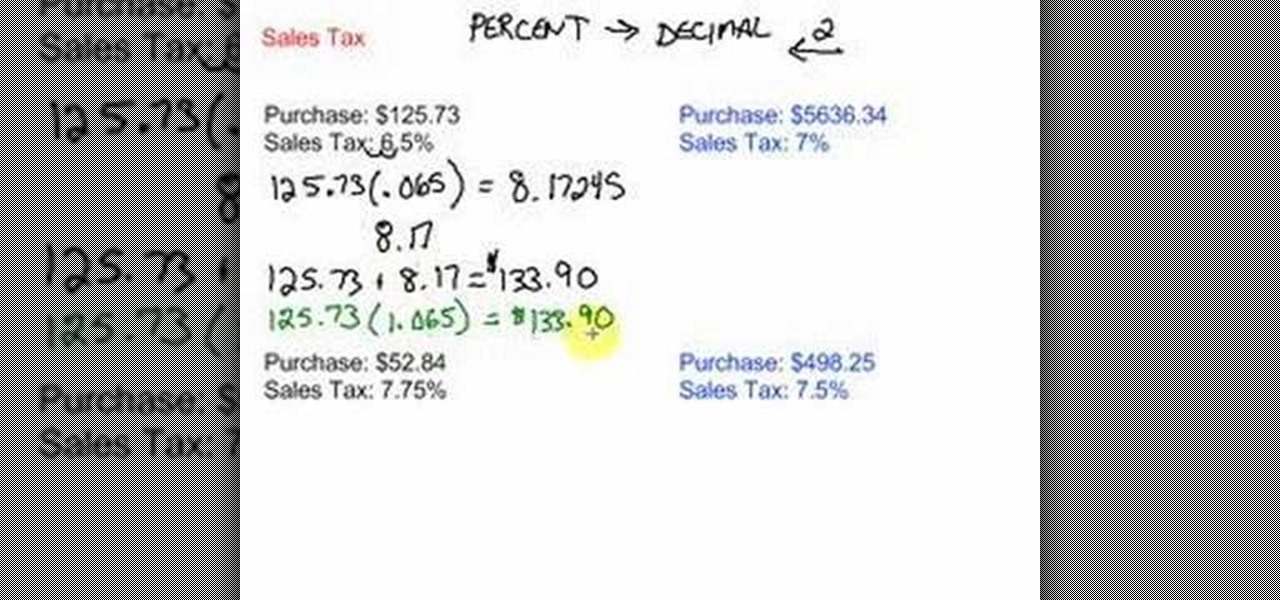

For example if your state sales tax rate is 4 you would multiply your net purchase price by 004. I would like to GO GREEN and receive emails instead of mailing me reminders.

How To Calculate Sales Tax Video Lesson Transcript Study Com

The 98665 vancouver washington general sales tax rate is 84.

. For State Use and Local Taxes use State and Local Sales Tax Calculator. Home Motor Vehicle Sales Tax Calculator. KarMART Volkswagen 1725 Bouslog Road Directions Burlington.

WarranteeService Contract Purchase Price. Car Loan Calculator Detailed for Washington. Motor vehicle titling and registration.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Washington local counties cities and special taxation districts. Youll find rates for sales and use tax motor vehicle taxes and lodging tax. Find a ram truck or jeep suv at our burlington dealer that fits your budget with low car sales tax rates.

Find your state below to determine the total cost of your new car including the car tax. This would happen if a vehicle was. Car loan calculator detailed for washington.

Wa car sales tax calculator. From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product. Remember to convert the sales tax percentage to decimal format.

Washington State Spirits Tax. The motor vehicle saleslease tax of three-tenths of one percent 03 on motor vehicles also applies when use tax is due on a vehicle. In our calculation the taxable amount is 37900 which equals the sale price of 39750 plus the doc fee of 150 minus the trade-in value of 2000.

Use tax is calculated at the same rate as the sales tax at the purchasers. 635 for vehicle 50k or less. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Search by address zip plus four or use the map to find the rate for a specific location. To calculate sales and use tax only. On top of that is a 03 percent leasevehicle.

The first is a sales tax of 205 for retail sales and 137 for sales made in restaurants and bars. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. To calculate sales and use tax only.

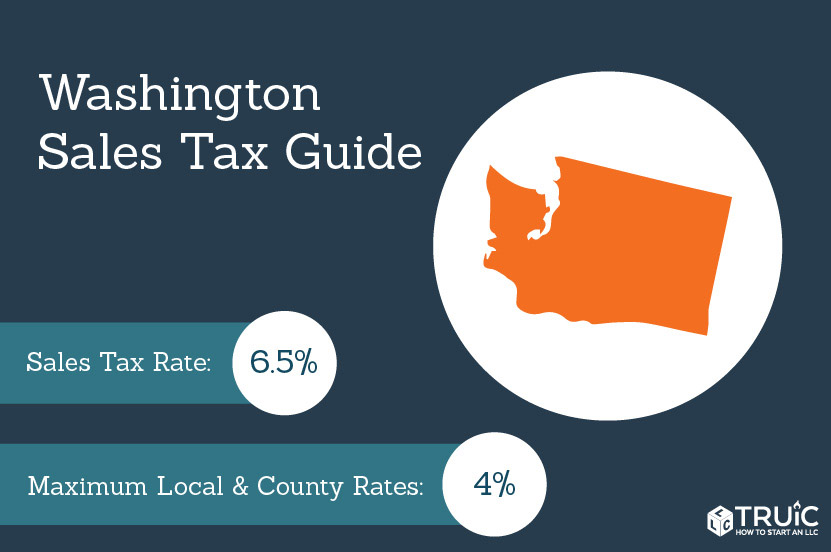

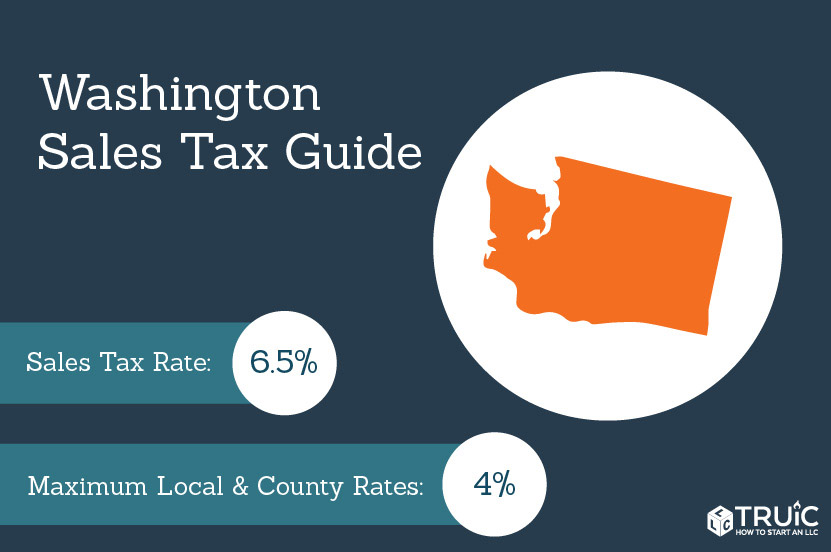

According to the Sales Tax Handbook a 65 percent sales tax rate is collected by Washington State. This level of accuracy is important when determining sales tax rates. Decimal degrees between -1250 and -116.

Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. Net Price is the tag price or list price before any sales taxes are applied.

In addition Washington county taxes are applied as well at a rate of 03 percent of the sales priceThe tax money collected is allocated toward various state funded services like road maintenance. Use tax is paid at the time a vehicle is registered with the Department of Licensing if sales tax was not paid at the time the vehicle was acquired by the current owner. Multiply the net price of your vehicle by the sales tax percentage.

Vehicle Sales Tax Calculator. For additional information click on the links below. Use this search tool to look up sales tax rates for any location in Washington.

775 for vehicle over 50000. Use tax is a tax on items used in Washington when sales tax hasnt been paid. When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction.

DOL fees are about 613 on a 39750 vehicle based on a flat fees that fluctuate depending on vehicle. Calculate a simple single sales tax and a total based on the entered tax percentage. 425 Motor Vehicle Document Fee.

The second is a volume tax called the spirits liter tax which is equal to 37708 per liter retail or 24408 per liter restaurants and bars. Total Price is the final amount paid including sales tax. Look up a tax rate.

According to the sales tax handbook a 65 percent sales tax rate is collected by washington state. Use tax rates. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The state of Washington taxes all sales of automobiles at a rate of 65 percent which is the standard retail sales tax.

Washington has a 65 statewide sales tax rate but also has 106 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2341 on. Car tax as listed. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

Discover Washington Car Sales Tax Calculator for getting more useful information about real estate apartment mortgages near you. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. There are two taxes on spirits in Washington.

Use our online sales tax calculator then speak with the auto finance experts at our VW dealer near Marysville WA. Skip to main content. Decimal degrees between 450 and 49005 Longitude.

2022 Business Information Systems. Curious about car sales tax in Washington. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. When you purchase a vehicle or vessel from a private party youre required by law to pay use tax when the vehicle or vessel title is transferred. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington.

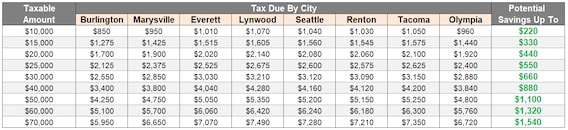

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax The Complete Guide To Sales Tax In The United States Taxjar

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator Foothills Toyota

How To Figure Out And Calculate Sales Tax Math Wonderhowto

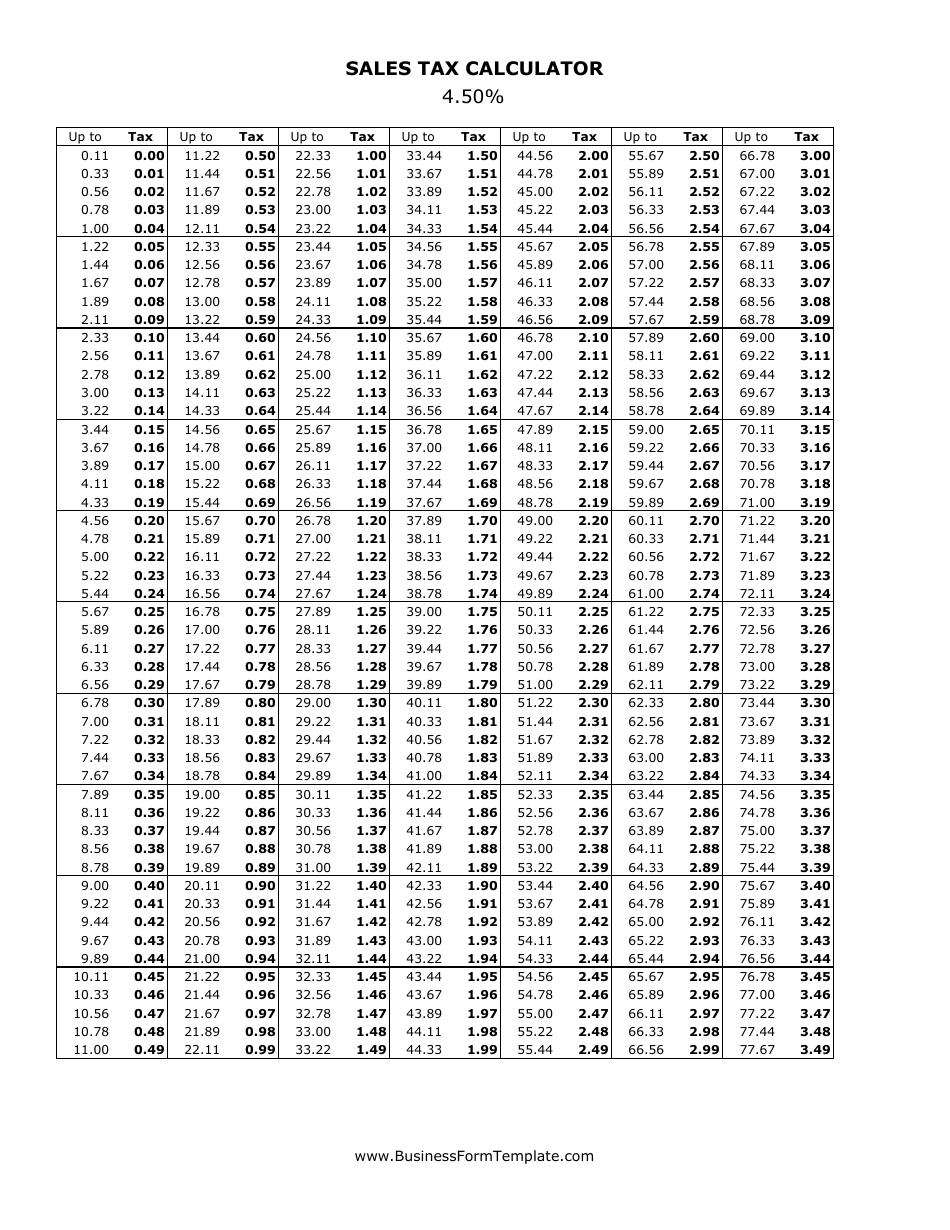

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

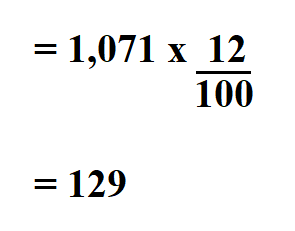

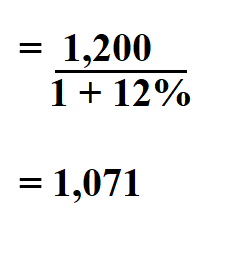

How To Calculate Sales Tax Backwards From Total

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa

How To Calculate Sales Tax Backwards From Total

Heloc Calculator To Calculate Maximum Home Equity Line Of Credit Interest Calculator Online Mortgage Online Calculator

States With Highest And Lowest Sales Tax Rates

What S The Car Sales Tax In Each State Find The Best Car Price

How To Calculate Cannabis Taxes At Your Dispensary

Washington Sales Tax Small Business Guide Truic